Industry-Leading hard money & dscr loans

No paystubs, no tax returns, no employment verification, no PFS, and no personal debt ratio calculations – just faster closings and greater opportunities. Allow us to finance your monthly payments to waive off bank statements. See if you qualify today!

Take 3 minutes to request a term sheet or proof of funds letter by clicking on one of the 5 loan types below. You can also read my reviews, book a call or send me a call, text or email 👇

Credentialed Private Money, Hard Money & DSCR Loans

With over 20 years of real estate experience, we focus on helping residential real estate investors grow their portfolios and build long-term wealth.

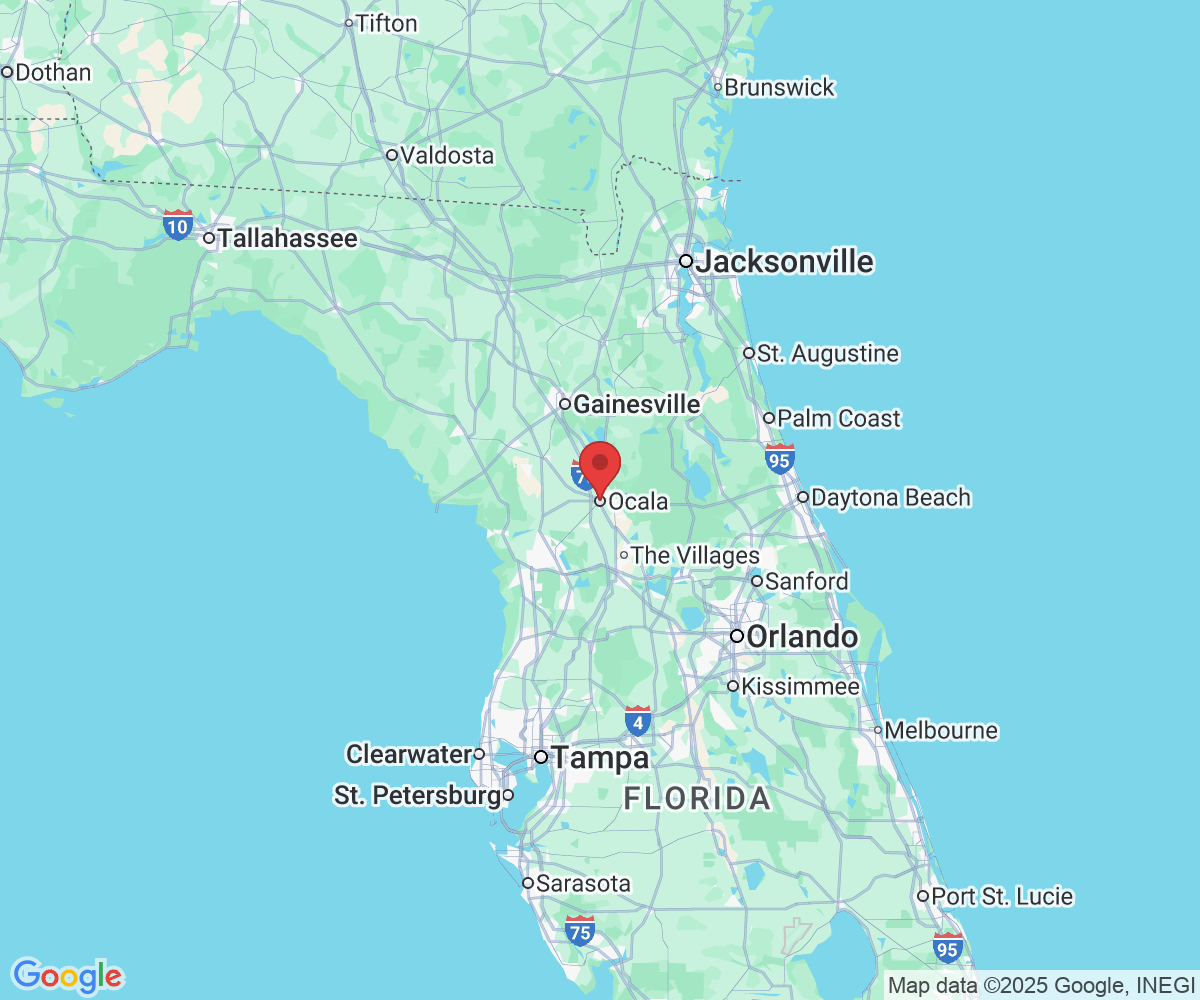

We offer No Doc Private Money, Hard Money and DSCR mortgage loans in 47 states, with first mortgage loans typically exceeding $350,000. Many loans are over $1.0 million.

Whether you're a Luxury Realtor, High Volume Rehabber, Home Builder or Landlord we invite you to request a custom quote and or POF letter using the questions above.

We look forward to providing you with nearly unlimited capital so you can reliably get your investments closed, cash-flowing or take cash out while the property is listed for sale.

Julie Ferraro, Loan Broker: (847) 942-0247

JJ or Kirsten VanderJagt, Direct Lender: (928) 302-8485

Frequently Asked Questions

What documents do I need to apply for a mortgage?

You’ll need our simple PDF loan application and disclosures, stamped articles of formation for your new or seasoned LLC, LP or Corporation, an operating agreement or bylaws which you can amend, property insurance, a credit report, title report and appraisal. I will order these last 3 items for you. You do NOT need proof of personal or business income, a personal financial statement, tax returns, and we do not ask about your employment. In many cases, you do not need seasoned assets or bank statements. Specific requirements vary by program.

If you are doing new construction a renovation or bridge loan with improved pricing or higher loan amounts, we may ask for a track record and a scope of work / budget if it applies. Please obtain your scope in writing from a licensed and insured contractor or subcontractor as per your county, city or state.

How quickly can we fund the loan?

COE (Close of Escrow) is realistically about 15 business days days: estimate 5 days for appraisal and title, estimate 5 days for legal documents and wire. Please be sure everyone is on board with this timeline. On a purchase, you could write the offer as 10-15 days and keep a 10-15 days extension in mind because Realtors deal in calendar days and lenders deal in business days.

Testimonials

Julieann's team has a remarkable knack for spotting the right opportunities and navigating the complexities of each deal with such precision. Their strategic approach not only secures great outcomes but also makes the entire process feel seamless for everyone involved.

— Luca B.

Julieann has been a pleasure to work with. Her clear communication and professionalism makes her a step above the rest. She has a very thorough knowledge of the lending process and her team is very responsive. Definitely reach out to her!

— Danielle D.

Julieann has provided me capital when I needed it. In fact, coming through right on time. She is professional, organized and exceptionally smart. She is also very reliable, and her communication skills are top notch. I appreciate her dedication to getting the job done.

— Kirsten V.

Location: 560 Northwest Highway, Palatine IL 60067

Call (847) 942-0247

Email: [email protected]

Site: www.privatemoneywithjulieann.com